Understanding the Art of Budgeting for Car Funding: Recognizing Month-to-month Repayments and Down Payments

Browsing the world of cars and truck financing requires a keen understanding of the complexities bordering monthly settlements and down payments. By thoroughly dissecting the components that comprise monthly payments and studying the subtleties of down repayments, individuals can equip themselves with the knowledge required to make enlightened and critical selections when it comes to financing a cars and truck.

Regular Monthly Payments: Trick Considerations

When considering month-to-month repayments for car funding, it is vital to carefully review your spending plan and monetary obligations. Month-to-month payments are a critical element of car funding as they straight influence your money flow each month. To start, analyze your present revenue and expenses to establish just how much you can easily designate in the direction of a vehicle settlement without straining your funds. It is recommended to go for a monthly settlement that is no more than 15% of your month-to-month net pay to guarantee cost.

Think about the funding term length and interest price when examining regular monthly payments. A much shorter funding term may result in greater month-to-month payments however reduced general interest prices, while a longer funding term could supply a lot more manageable month-to-month payments yet at the cost of higher passion fees over time.

Down Repayments: Effect on Funding

Having actually established the value of thoroughly evaluating regular monthly payments in auto funding, the effect of down payments on funding arrangements ends up being a crucial aspect to think about in identifying the overall cost and terms of the finance. Deposits are ahead of time payments made at the time of acquiring a car and have a straight influence on the funding terms. A larger down payment normally results in reduced month-to-month repayments as the first cost of the automobile is decreased, hence reducing the quantity that needs to be funded. Additionally, a considerable deposit can additionally lead to lower rate of interest, saving the purchaser cash over the life of the car loan. On the other hand, a smaller sized deposit means higher regular monthly payments and potentially higher rate of interest, which can enhance the overall expense of the automobile with time. For that reason, comprehending the influence of down payments on funding is critical in making educated choices that straighten with one's spending plan and economic objectives.

Budgeting Tips for Vehicle Financing

Efficient budgeting is important for efficiently managing auto financing and making certain financial security throughout the lending term. When budgeting for auto financing, begin by computing your regular monthly revenue and expenses to identify just how much you can comfortably designate in the direction of an automobile settlement. It's essential to think about not simply the regular monthly financing repayment however additionally additional expenses like gas, upkeep, and insurance policy. Setting a sensible spending plan will help you prevent economic pressure and potential default on payments.

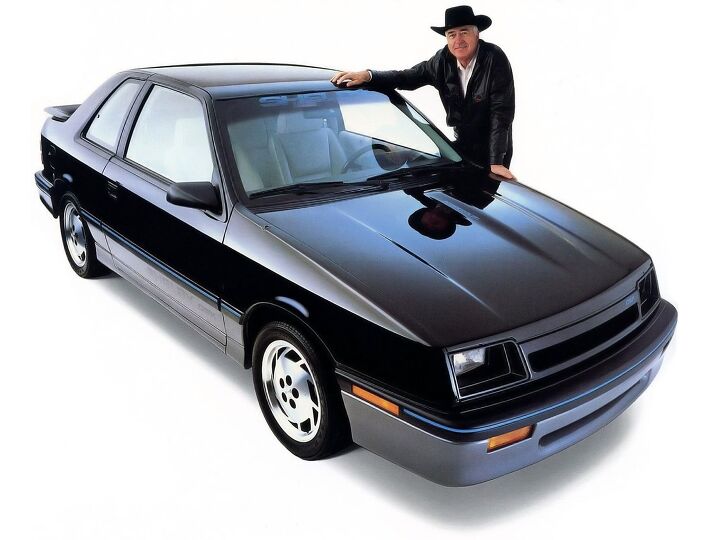

An additional budgeting tip is to conserve for a deposit to minimize the overall amount financed and potentially secure a better rate of interest. Cutting down on unneeded expenses and alloting a particular amount every month can assist you reach your down payment objective quicker. Additionally, take into consideration the financing term very carefully. New chrysler Morris IL. While longer lending terms might reduce month-to-month repayments, they frequently cause paying much more in rate of interest gradually. Going with a much shorter car loan term can aid you reduce passion and pay off the auto quicker. By adhering to these budgeting suggestions, you can much better manage your cars and truck financing and accomplish economic assurance.

Discussing Approaches for Better Terms

To optimize the terms of your vehicle funding, it is critical to use calculated settlement methods that can lead to more favorable problems for your financing arrangement. When discussing for better terms on your car loan, prep work is essential.

Another effective approach is to take advantage of pre-approved financing deals. By understanding what car loan terms you qualify for ahead of time, you can utilize this as a criteria during negotiations with the dealership or lending institution (New chrysler Morris IL). Additionally, do not be reluctant to bargain on all elements of the lending arrangement, consisting of interest prices, funding duration, and any kind of extra costs

Recognizing Finance Terms and APR

Comprehending loan terms and APR is crucial for making notified choices when protecting car funding. Lending terms describe the length of time you have to settle the car loan, typically varying from 36 to 72 months for car fundings. A longer loan term may cause lower regular monthly settlements yet could cause paying extra in interest gradually. On the various other hand, a shorter car loan term might suggest higher monthly repayments yet much less interest paid in general.

APR, or Annual Portion Price, stands for the cost of loaning, consisting of interest and charges, expressed as a portion. A reduced APR shows a better offer as it indicates reduced overall expenses for the financing (New chrysler Morris IL). Variables that influence APR include your credit report score, the funding quantity, the financing term, and the lender's policies

When comparing funding deals, pay attention to both the car loan terms and APR to comprehend the complete price of borrowing. A clear understanding of these factors will equip you to select a cars and truck funding option that aligns with your budget and financial goals.

Conclusion

Finally, mastering the art of budgeting for vehicle financing requires careful consideration of monthly payments, down payments, and finance terms. By recognizing these vital factors and executing budgeting ideas and working out techniques, individuals can protect much better financing terms and handle their expenditures successfully. When purchasing a vehicle., it is vital to assess funding terms and APR to make sure a clear understanding of the financial dedication and make notified decisions.

Navigating the world of automobile financing calls for an eager understanding of the complexities bordering regular monthly payments and down settlements. jeep dealer near morris By thoroughly studying the elements that constitute monthly settlements and studying the subtleties of down payments, people can equip themselves with the knowledge required to make educated and strategic options when it comes to funding a cars and truck. A much shorter finance term may result in greater regular monthly payments however lower general interest expenses, while a longer finance term might supply a lot more workable month-to-month repayments yet at the expense of greater interest costs over time.Having developed the importance of meticulously assessing month-to-month payments in automobile funding, the impact of down settlements on financing setups ends up being an essential aspect to take into consideration in determining the total affordability and terms of the loan.In final thought, understanding the art of budgeting for auto financing requires cautious factor to consider of month-to-month settlements, down payments, and finance terms.

Comments on “Top Jeep Dealer Near Morris: Discover the current Jeep Versions and Deals”